It's All About the CLOs

A somewhat complex and highly misunderstood asset class, CLOs offer attractive high yield income with manageable downside risk for the serious income investor.

Be not afraid of the dark unknown, for shall you venture forth be prepared to meet greatness in the offing! (Rudyard Kipling, as imagined by the author)

If you are seeking passive income from your investments to support or supplement other income sources in your retirement, you may wish to consider a class of funds that are relatively new to retail investors. Institutions have been trading CLOs for many years now, but publicly traded CEFs (closed end funds) that hold CLOs have only been around for a little over a decade. If you want to understand more about CLOs, what they are, how they work and why they are attractive now, I like this recent article from Pinebridge that is focused on the equity portion of CLOs, which are the most attractive but also highest risk right now.

CLO Equity: How It Works – and Why It’s Compelling Now

Over the past 30 years, collateralized loan obligations (CLOs) have grown from a niche asset class into a $1.2 trillion pillar of the corporate financing markets, representing about 70% of demand for US corporate loans today.1 The variable-rate CLO debt securities issued on the backs of these loans have become a mainstay of institutional portfolios, given their dependable, and frequently attractive, yields.

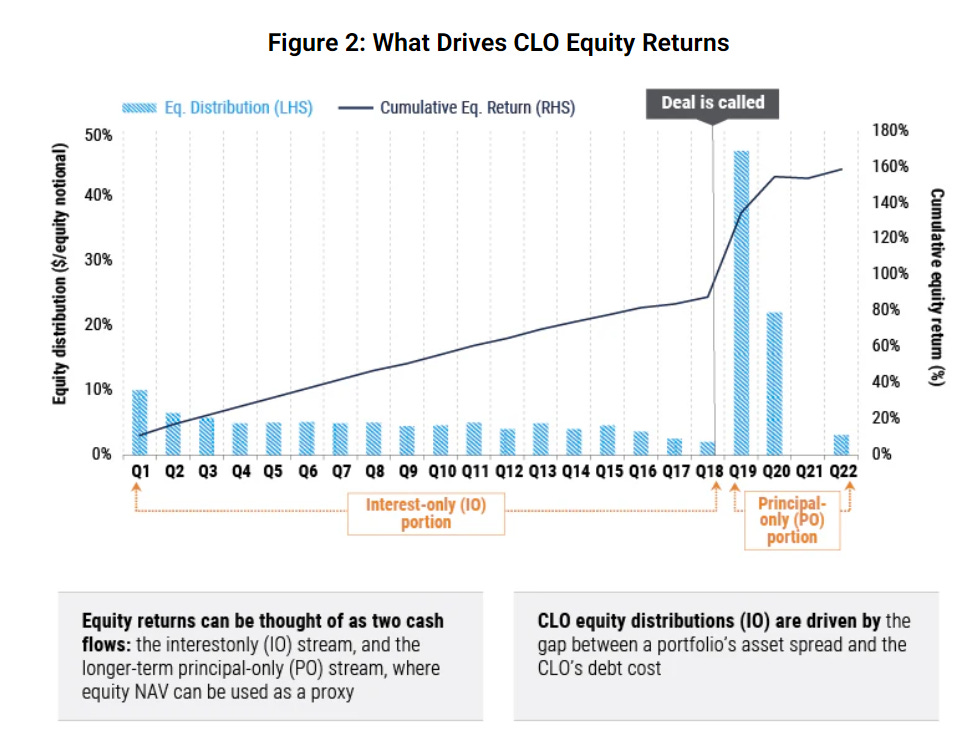

Yet CLOs offer another attractive option for investors: their equity tranches, which capture the difference between what a CLO earns in loan interest and what it owes the CLO debtholders. For a certain group of discerning investors, this is the most interesting part of a CLO – a hybrid investment combining the prospective double-digit returns of private equity with a quarterly distributed front-loaded cash flow more akin to bonds.

There are now quite a few CEFs and ETFs that offer income from investing in CLOs. Each one has a slightly different portfolio mix including even some senior loans in both XFLT and ARDC, which each hold a mix of loans, CLO equity, CLO debt, and perhaps a small amount of other fixed income securities.

Closed End Funds that Hold CLOs

The biggest and oldest of the CLO equity CEFs include Oxford Lane Capital Corporation (OXLC), which went public in 2011, and Eagle Point Credit Company (ECC), incepted in October 2014. I just wrote in detail about OXLC on Seeking Alpha if you would like to know more about this CEF that yields nearly 19% at the current price with a well covered dividend of $0.08 per share paid monthly. Also, OXLC offers shareholders a DRIP (dividend reinvestment) discount of 95% of market price regardless of whether it trades at a discount or premium to NAV.

Another, smaller CEF that holds mostly CLO equity and some CLO debt as well (~70% equity and 25% debt) is OFS Credit Company Inc (OCCI). I also just published a detailed update on OCCI that although much smaller in size has outperformed both ECC and OXLC in the past 6 months, which was when they switched from quarterly dividends with max 20% cash to monthly all-cash distributions.

Another relatively new CEF that invests in mostly the equity portion of CLOs is Carlyle Credit Income Fund (CCIF). This article is behind a paywall now but goes into detail about how the CEF that used to have the ticker symbol VCIF and held mortgage loans and such, converted to a CLO fund run by Carlyle. This was what I wrote in that article, which was published in December 2023:

It is important when evaluating CCIF to consider only the distributions that have been announced or paid since September because any prior history was a different fund (VCIF) that did not have the benefit of CLO equity investments. It is still early in the fund's history but with now six months of dividends declared at $0.0994 through February 2024, I believe that CCIF is well positioned to deliver consistent high yield income from its CLO equity investments for many years to come and stacks up nicely against peers such as ECC and OXLC.

In March CCIF increased the dividend (to $0.105 per share) and now the total return over the past 6 months has indeed been comparable to both ECC and OXLC. OCCI has outperformed the other three in the past 6 months, but they have all returned 11-12% or more in the last half year, with OCCI offering a total return of 25%.

Exchange Traded Funds (ETFs)

I do not know a lot about the ETFs except to know that there are a lot of new ones! Here are some tickers for several that I know about: JAAA (holds mostly AAA rated CLOs), JBBB (holds BBB rated ones, I own some of this one), CLOZ, CLOX, CLOI, CLOA, ICLO, PAAA, and AAA.

I have not done much research on these, but I expect that each of the ETFs is “actively managed” meaning they do not just follow an index. The fund managers need to be experienced in trading and reinvesting CLOs in order to effectively manage the fund. Most CLOs have a 5 year reinvestment period which can be sometimes be extended by up to two years. A lot can change in 7 years!

The higher rated CLOs (AAA rated) are considered near investment grade in terms of risk, but offer much lower yields. Many of these funds yield slightly more than 5% and up to 8% or more depending on the mix of ratings in their portfolios while carrying risk that is not very interest rate dependent and over many years has resulted in negligible downside.

As a relatively safe cash alternative, some of these ETFs may make sense if you are willing to understand and accept the risk. I personally use JBBB (current yield about 7.8%) for that purpose in my own retirement account along with SGOV (iShares® 0-3 Month Treasury Bond ETF), which only yields about 5% but carries very low risk.

Get Some CLOs for the Income, Not Growth

When I write about some of these funds, many investors just go look at a chart of the price of the fund over time and tell me that I must be crazy to recommend such a piece of trash. Those investors are expecting to see a chart that goes up and to the right and what they see looks just about the opposite. This is especially true of any 5-year charts right now because of the “Covid effect”. Just to make a point, here is the chart showing just the price of OXLC compared to the S&P 500 over the past five years from Yahoo.

Do you see all those little D symbols at the bottom? Those are all the monthly dividends paid out that are not shown in the chart because the price has nothing to do with the dividends, right? Or do they? As an income investment, the income received over the past 5 years is what is important, the price is mostly irrelevant. To help make that point, I used Portfolio Visualizer to show me the income that would be received from a 100% investment in OXLC against the Vanguard 500 Index Investor benchmark to compare performance.

The annual total return for OXLC is of course much worse than the benchmark because of the huge impact that Covid had on OXLC, but it has since recovered from a total return perspective (meaning share price gains plus dividends reinvested). However, my reason for holding OXLC is not to beat the market. It is to generate income. So the other nice thing about the PV software is that it shows how much income would have been generated over that same five year period.

The average is about $1,500 per year but is growing. This year will be likely more than $2,000 assuming no major catastrophes occur between now and the end of the year.

Summary - Why Buy CLOs?

The CLO asset class has been catching on like wild fire (listening to Wildfire by John Mayer as I type this inspired that comment). I just listed 10 new ETFs that hold CLOs and that is in addition to the other 6 CEFs that I mentioned that also hold CLOs or some mix of loans and CLOs. (And there others I did not mention like EIC).

This writeup from Carlyle explains in a nice summary form why CLOs (and especially CLO equity) and why now?

Why CLO Equity

CYCLE TESTED STRATEGY:

Collateralized loan obligations (“CLOs”) have a multi-decade track record of withstanding market shocks including the global financial crisis (GFC), global energy crisis, COVID-19, and 2022 volatility.

ATTRACTIVE RETURNS1:

CLO equity has historically generated high cash-on-cash returns2 with an average annual CLO equity distribution of ~16%.3

All CLO vintages have on an aggregate basis achieved a positive return with an average return of ~13% for realized deals.3

STRONG UNDERLYING COLLATERAL:

CLOs consist of diversified portfolios of broadly syndicated, liquid, senior secured corporate loans with an average facility size of $920mm.4

Each CLO typically has more than 200 distinct loans diversified across a wide range of industries.

Loans are senior to bonds and equity with first priority to underlying collateral pledged by the borrower. As a result, loans have a historical high recovery rate of 63%5

Since inception in 1997, the LSTA U.S. Leveraged Loan Index has only had 3 years of negative returns6

LARGE ASSET CLASS:

The U.S. CLO market is over $1 trillion in size today and continues to grow.7

The LSTA U.S. Leveraged Loan Index has grown from $1.15 trillion to $1.40 trillion over the last five years.4 Since CLOs account for over 60% of the U.S. leveraged loan market, the growth of the loan market creates a need for CLO creation.8

ATTRACTIVE FINANCING STRUCTURES

CLOs have long-term financing (typically 13 years)

CLOs generally are not subject to covenants requiring margin calls or forced liquidations triggered by decreases in the value of collateral.

6. BENEFIT FROM VOLATILITY:

CLOs are actively managed vehicles with five year reinvestment periods

Reinvestment allows for ongoing portfolio optimization

Since financing is locked-in for an extended period, CLOs benefit from volatility as they can purchase loans at discounted prices and / or higher spreads to increase returns

7. TRANSPARENCY AND REPORTING

Detailed monthly reporting provided by an independent trustee

Reports include name-by-name positions in the CLO and calculations of required tests

Thanks for reading! Please leave a comment below if you want to add to the discussion.

I’m currently reading The Income Factory & follow you and Steven on SA. You both have me intrigued by this investment type…thanks for this great article and for what you do on SA!

Thanks Damon: I hold many of the funds you mentioned, thanks to Steven Bavaria.